In 2012, China's hardware industry gradually got rid of the impact of the financial crisis. With the domestic and foreign markets gradually recovering, while maintaining the European and American international markets, China's hardware industry gradually got rid of the impact of the financial crisis in 2012. With the domestic and foreign markets gradually recovering, China's hardware enterprises are maintaining the market. While protecting the international markets in Europe and the United States, we will gradually focus on larger markets abroad, and increase channels and brand building efforts in the domestic market. In recent years, with the acceleration of global economic integration, China's stainless steel hardware tool processing industry has gradually become the main force of the world's hardware tool industry. The demand for hardware tools in some developed countries, especially in developing countries such as Africa and the Middle East, increases at a rate of more than 10% annually.

Hardware tools are labor-intensive industries. Yongkang, as the home of hardware, once became the gathering place of hardware tools by virtue of its traditional competitive advantage of low cost. At the same time, the requirements of the international market for China's hardware products will gradually develop and change. There will be higher requirements for the quality, packaging and delivery period of Chinese products, and even gradually extend to the production process and product research and development, combining products with environmental protection, energy resources and human environment. And the huge attraction of market and central position will further attract the manufacturing centers of multinational hardware companies to move to China. The integration with foreign enterprises will continuously improve the quality of Chinese hardware products and the competitiveness of enterprises. While continuing to expand the markets of traditional countries such as the United States and Japan, it will also blossom in Southeast Asia, the Middle East, Russia, Europe and Africa. According to the growth rate of 2006-2011, global sales of industrial fasteners are expected to grow at an annual rate of 5.2%, reaching $82.9 billion by 2016, said Luo Baihui, Chief Information Officer of Golden Model Electrical Network.

Most of the world's economies will continue to recover from the financial crisis in 2009 and continue to stimulate the growth of durable goods production to substantially boost global fastener sales. Luo Baihui pointed out that in 2011, the automotive OEM industry is the largest demand market for fasteners, and it is expected that by 2016, the market will have the largest growth point in the amount. At the same time, the accelerated growth of manufacturing output and fixed investment expenditure will also promote the growth of fastener usage in the mechanical field. However, the fierce competition from alternative connection technologies (such as adhesives) will inhibit the sales growth of fasteners in some market areas.

From 2011 to 2016, the Asia-Pacific region is expected to achieve the strongest demand growth at an average annual rate of 7.4%, mainly due to the promotion of Chinese market demand. Although China's future growth trend will be slower than that of 2006-2011, it will continue to drive fasteners growth in the whole Asia-Pacific region with strong demand. The rise in demand from relatively small Indian markets will compensate for China's reduced demand, as sales of fasteners in India will climb at the fastest rate in the world by 2016. Smaller countries, the growth of durable goods manufacturing and the sustained growth of infrastructure demand for new and improved components will together promote a substantial increase in the demand for industrial fasteners.

During the period 2006-2011, demand for industrial fasteners in developed economies (such as the United States, Western Europe and Japan) grew much slower than in developing countries, and sales growth in developed countries will continue to underperform by 2016. Because the durable goods industry in these areas has developed more maturely, fastener suppliers have less opportunities for growth. Nevertheless, after a recession, the recovery in car production and construction spending will lead to faster growth in future fastener sales. Developed countries are still major suppliers of aerospace fasteners. Multinational enterprises will continue to build factories in China and other industrial developing countries, mainly using the low-cost advantages of these regions to produce low-end fasteners. Nevertheless, the United States, Western Europe and Japan will remain major suppliers of high-end fasteners such as aerospace.

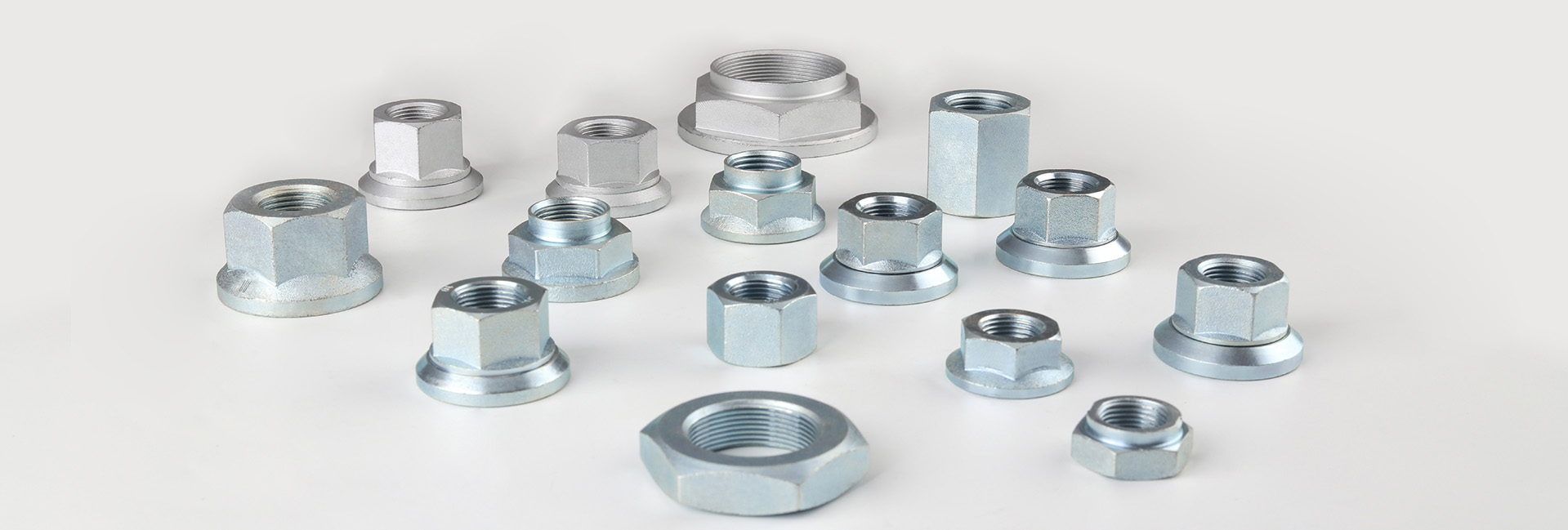

External threaded fasteners have the largest total demand

In terms of product categories, standard external threaded fasteners occupy half of the total market share of industrial fasteners in 2011, and are expected to become the largest type of industrial fasteners in total demand by 2016, mainly due to the growth of production of various durable goods. However, due to the growth of investment in infrastructure and the production of large capital goods in developing countries, non-threaded fasteners have significant advantages in safety and permanent connection, and will show the fastest growth rate. Global demand for industrial fasteners in 2011 was $64.4 billion: 52% for external fasteners, 17% for internal fasteners, 17% for non-threaded fasteners, 7% for special purpose fasteners and 7% for aerospace fasteners.